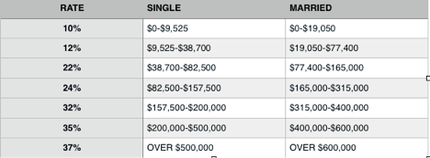

NEW TAX BILL FINAL BRACKETS

STANDARD DEDUCTION

SINGLE - $12,000

HEAD-OF-HOUSEHOLD - $18,000

MARRIED FILING JOINT - $24,000

MORTGAGE INTEREST DEDUCTION CAPPED AT $750,000 ON ACQUISITION INDEBTEDNESS BEGINNING AFTER 12/31/17. $375,000 IN THE CASE OF MARRIED FILING SEPARATELY.

FOR MORTGAGE INTEREST ON ACQUISITION INDEBTEDNESS BEFORE 12/15/17 MORTGAGE INTEREST DEDUCTION IS RETAINED UP TO $1,000,000. $500,000 IN THE CASE OF MARRIED FILING SEPARATELY.

MORTGAGE INTEREST IS STILL ALLOWED ON SECOND HOMES BUT WITHIN LOWER DOLLAR CAPS.

NO MORTGAGE INTEREST IS ALLOWED FOR HOME EQUITY INDEBTEDNESS.

DEDUCTION FOR STATE AND LOCAL TAXES INCLUDING PROPERTY TAXES IS LIMITED TO $10,000 ($5,000 MARRIED FILING SEPARATELY)

SALES TAXES MAY BE CLAIMED AS AN ALTERNATIVE TO STATE AND LOCAL INCOME TAXES.

MISCELLANEOUS DEDUCTIONS SUBJECT TO 2% FLOOR OF ADJUSTED GROSS INCOME HAVE BEEN ELIMINATED.

MEDICAL DEDUCTION HAS BEEN RETAINED WITH DEDUCTIONS MUST EXCEED 7.5% OF ADJUSTED GROSS INCOME. (10% FLOOR HAS BEEN ELIMINATED)

CHILD TAX CREDIT HAS BEEN INCREASED TO $2,000 ($1,400 IS REFUNDABLE WHICH MEANS THAT YOU COULD RECEIVE THIS AMOUNT PER CHILD EVEN IF YOU DON’T OWE TAX)

PERSONAL EXEMPTIONS HAVE BEEN ELIMINATED

ESTATE TAX EXEMPTION HAS BEEN INCREASED TO $11,200.000 PER INDIVIDUAL

AMT (ALTERNATIVE MINIMUM TAX) LIMIT HAS BEEN INCREASED SO FEWER WILL BE ASSESSED THIS TAX

CORPORATE TAX RATE IS 21%

PERSONAL SERVICE CORPORATION TAX RATE STILL 35%

AFFORDABLE CARE ACT INDIVIDUAL MANDATE HAS BEEN REPEALED